The updates below reflect new information received within the past few days and over the weekend regarding some specific carriers and industry information. Load-to-truck ratios in March tell an interesting story as well – have we already witnessed the spot-market peak?

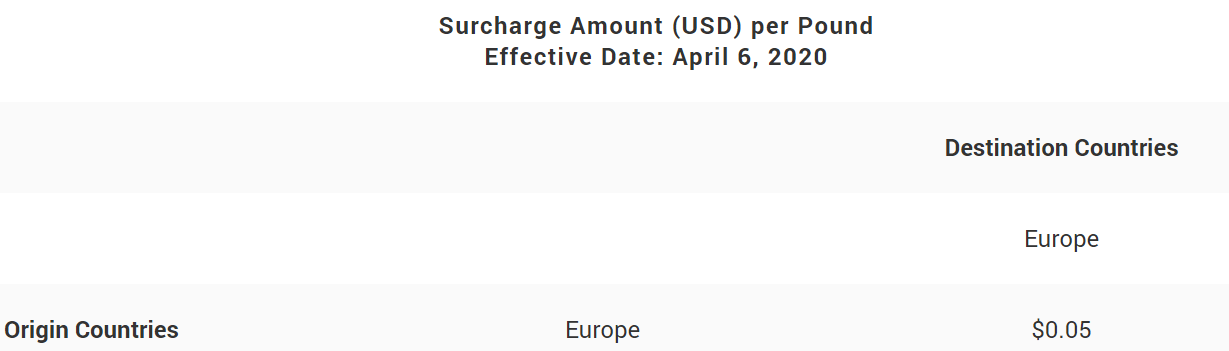

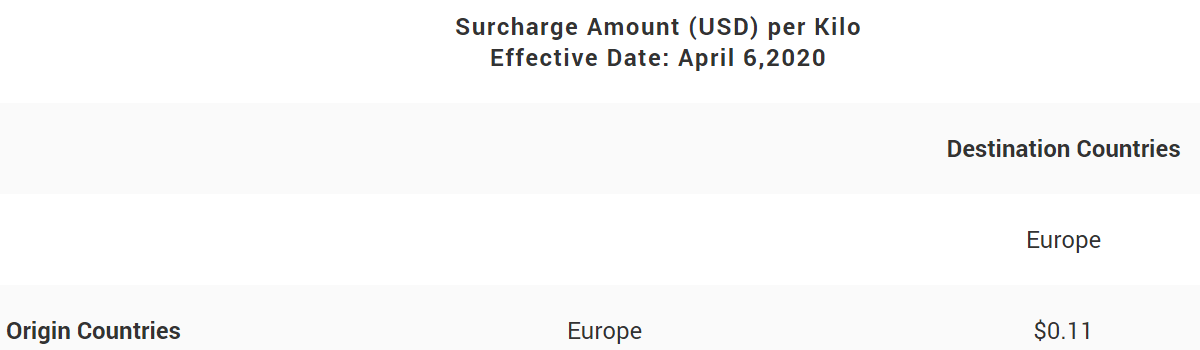

FedEx Express

- Beginning Monday April 6, 2020 a surcharge for all FedEx Express® parcel and freight will go into effect according to the following schedule:

- Beginning Monday April 6, 2020 a surcharge for all TNT International Economy Services will go into effect according to the following schedule:

Central Freight Lines – Volunteer Express

- Central Freight Lines acquired Volunteer Express

- All shippers should continue to contact Volunteer Express for pickups until further notice

- Beginning Monday April 6, 2020 the trucks and trailers for all shipments scheduled with Volunteer will belong to Central Freight Lines

- Pricing in place with Volunteer Express may or may not be honored – the decision will come quickly

The Spot-Market Peaked at the end of March

Everyone agrees the shipping industry will not return to normal for many months with some going as far as to say it will be the holiday season before the freight market is looks like years passed. That doesn’t mean we know nothing and are incapable of making a few educated guesses.

Things We Know:

- Unfortunately for carriers, we have already seen the peak in the load-to-truck ratios during this pandemic and the financial difficulties for carriers are just beginning – particularly if they do not have a diverse portfolio of shippers.

The Dry Van Load-to-Truck Ratios as posted by DAT for the month of March:- Week ending 3/08: 2.40 loads per truck

- Week ending 3/15: 3.16 loads per truck

- Week ending 3/22: 3.52 loads per truck

- Week ending 3/29: 2.81 loads per truck

The Flatbed Load-to-Truck Ratios as posted by DAT for the month of March:- Week ending 3/08: 25.79 loads per truck

- Week ending 3/15: 27.74 loads per truck

- Week ending 3/22: 23.25 loads per truck

- Week ending 3/29: 15.31 loads per truck

The Reefer Load-to-Truck Ratios as posted by DAT for the month of March:- Week ending 3/08: 4.63 loads per truck

- Week ending 3/15: 6.17 loads per truck

- Week ending 3/22: 7.77 loads per truck

- Week ending 3/29: 4.91 loads per truck

- COVID-19 hasn’t peaked yet and until it does we cannot make an accurate prediction on when the economy will stabilize. Additionally, until we can predict businesses getting back to normal operations we cannot know exactly when to expect freight operations to return to normal.

- Freight began this ebb and flow with China’s decreased output as their workforce was the first affected. As China began a rebound in manufacturing, the United States and Europe began their own declines.

- The pandemic began on the back of the Chinese New Year when imports are typically lower than usual.

- With efforts to curb the rapid spreading of this pandemic – international air travel restrictions were put in place decimating the air cargo capacity and sending air freight prices sky high.

- As conditions worsened in the US, consumers began panic-buying in an effort to stock up on essentials and heed “stay-at-home” orders issued by state and local governments.

- This emptying of grocery store shelves for items consumers deemed essential, began the meteoric rise in the load-to-truck ratio for refrigerated food items, dry goods, and various home goods and chemicals. Meantime, across other sectors of the US economy tanked as other businesses began shuttering or slowing down.

- The increase in only one very specific area of the economy and the decline across all others has led to artificially inflated trucking prices. Carriers are charging more per mile but making less money because the back hauls aren’t there and they are driving much further out of their regular lanes for these pickups.

- Finally, many carriers are implementing surcharges and not honoring rates during this time. I think most shippers understand these practices as this has always been the nature of freight market.

“Most Likely” Speculating

- The US will most likely see the COVID-19 peak in May or June with possible worst case scenarios being as late as August.

- As the demand for air freight continues to dwindle as regular manufacturers are slowing down operations, the prices will begin to come down with the exception of the International COVID-19 Surcharges that have been put in place by carriers.

- The Spot Market rates will begin to trend back downward, but not as low as they were before the pandemic as the opportunities for backhauls will remain scarce until the majority of businesses pick back up to normal operations. Additionally, as produce season kicks into full gear around the first week of May, rates will continue a bit elevated even after they are seasonally adjusted.

- The big trends that were beginning or in full swing before the pandemic will continue after businesses begin operating regularly again. Some trends have been amplified because of the pandemic, namely online shopping. For years we have seen brick and mortar stores give way to e-commerce with behemoth Amazon at the top of the list. Grocery items are now the fastest growing sector of e-commerce with many stores who have never offered online ordering – now offering it in the wake of social distancing. This pandemic was the push many needed to try out ordering groceries online and take advantage of grocery delivery. Many will continue the practice long after stay-at-home orders are lifted.

.png?width=770&name=baby%20truck%20(1).png)